UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under | |

Kirby Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

| KIRBY | 2020 PROXY STATEMENT | 1 | |

March 5, 2020

On behalf of the Board of Directors (the “Board”), we cordially invite you to attend Kirby Corporation’s 2020 Annual Meeting of Stockholders. Information concerning the matters to be voted upon at the meeting is contained in this Notice of the 2020 Annual Meeting and Proxy Statement.

Looking back on 2019, the year can be characterized by very different market conditions in each of our core businesses. In marine transportation, although inland operations were challenged by historic flooding on the Mississippi River System, improving market conditions and our recent investments in the inland and coastal fleets contributed to significant year-on-year growth in revenues and operating income. This was offset, however, by the impact of a cyclical downturn in our oil and gas related distribution and services businesses. Overall, the Company generated significant free cash flow which was used to fund growth in inland marine and pay down debt.

In marine transportation, we continue to make strategic investments to improve the efficiency and average age of our fleet. In March 2019, we completed the purchase of Cenac Marine Services, LLC’s (“Cenac”) young marine transportation fleet including 63 inland tank barges, 34 inland towboats, and two offshore tugboats. We also invested in new modern horsepower, delivering seven new inland towboats, two of which were constructed in our own shipyard, as well as three new state-of-the-art coastal tugboats. These investments, together with the commencement of operations for our new 155,000 barrel coastal articulated tank barge, have strengthened Kirby’s fleet in our core markets and will enhance future profitability and stockholder returns.

In distribution and services, significant reductions in oilfield activity and customer spending in North America resulted in a challenging year for this segment. In response, we took decisive actions to lower our cost structure, reduce working capital, and streamline our oil and gas related businesses so that we will emerge from the downturn as a stronger and more efficient company. Beyond oil and gas, our commercial and industrial portfolio had a strong year, with growth in the power generation, marine, and on-highway sectors. These diverse businesses are poised for further growth in the coming years and provide a base of stable financial performance.

In our Corporate functions, 2019 was a busy and successful year, with numerous projects completed which strengthen Kirby for future success, including: critical enhancements to our information technology and cybersecurity infrastructure; implementation of a new payroll and benefits tracking system; and improved financial flexibility through an increase in the term and size of our bank credit facility. At the Board level, we enhanced the experience and capabilities of the Board with the election of our tenth director, Tanya S. Beder. Ms. Beder brings a wealth of professional, financial, and academic experience, as well as critical operational and risk management knowledge which will be invaluable to Kirby in the years ahead. We ask that you support the nomination of Ms. Beder in this year’s proxy vote.

Your vote is important to us, regardless of the number of shares you hold or whether you plan to personally attend the meeting. Once you have reviewed the proxy materials and have made your decision, please vote your shares using one of the methods outlined in the Proxy Statement.

Thank you for your continued support and for investing in Kirby Corporation.

| Sincerely,

DAVID W. GRZEBINSKI President and Chief Executive Officer |

| 2 | KIRBY| 2020 PROXY STATEMENT | |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

| |||||

Notice of 2018

Annual Meeting of Stockholders

and

Proxy Statement

Meeting Date: April 24, 2018

YOUR VOTE IS IMPORTANT

PLEASE PROMPTLY MARK, DATE, SIGN AND RETURN

YOUR PROXY CARD IN THE ENCLOSED ENVELOPE

KIRBY CORPORATION

55 Waugh Drive, Suite 1000

P. O. Box 1745

Houston, Texas 77251-1745

March 6, 2018

Dear Fellow Stockholders:

On behalf of the Board of Directors, we cordially invite you to attend the 2018 Annual Meeting of Stockholders of Kirby Corporation to be held on Tuesday, April 24, 2018, at 10:00 a.m. (CDT). The meeting will be held at 55 Waugh Drive, 9th

Election of three Class I directors;

Election of one Class II director;

Ratification of the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for 2020; and

You have the right to receive this notice and vote at the Annual Meeting if you were a stockholder of record at the close of business on March 2, 2020. Please remember that your shares cannot be voted unless you sign and return the enclosed proxy card, vote in person at the Annual Meeting, or vote your shares via the phone or internet.

The mailing address of Kirby’s principal executive offices is P.O. Box 1745, Houston, Texas 77251-1745.

Your Vote is Important

Your vote is important. Whether you intend to attend the meeting or not, please ensure that your shares will be represented by completing, signing and returning your proxy card in the envelope provided, or by voting via the phone or internet.

|  |  |  | |||||

| In Person | Telephone800-690-6903 | Internet www.proxyvote.com | Fill out your proxy card and submit by mail. |

Sincerely,

AMY D. HUSTED

Vice President, General Counsel and Secretary

| KIRBY | 2020 PROXY STATEMENT | 3 | |

This booklet contains the notice of the Annual Meeting and the Proxy Statement, which contains information about the proposals to be voted on at the meeting, Kirby’s Board of Directors and its committees and certain executive officers. This year you are being asked to elect three Class II directors, ratify the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for 2018 and cast an advisory vote on executive compensation.

In addition to the formal proposals to be brought before the Annual Meeting, there will be a report on our Company’s operations, followed by a question and answer period.

Your vote is important. Please ensure that your shares will be represented at the meeting by completing, signing and returning your proxy card in the envelope provided whether or not you plan to attend personally.

Thank you for your continued support and interest in Kirby Corporation.

|

|

|

KIRBY CORPORATION

55 Waugh Drive, Suite 1000

P. O. Box 1745

Houston, Texas 77251-1745

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERSto:

| 1. |

| |||

Proposals to be voted on at the Kirby Corporation 2018 Annual Meeting of Stockholders are as follows:

1. Election of three Class II directors;

2. Ratification of the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for 2018; and

3. Advisory vote on the approval of the compensation of Kirby’s named executive officers.

You have the right to receive this notice and vote at the Annual Meeting if you were a stockholder of record at the close of business on March 1, 2018. Please remember that your shares cannot be voted unless you sign and return the enclosed proxy card, vote in person at the Annual Meeting, or make other arrangements to vote your shares.

We have enclosed a copy of Kirby Corporation’s 2017 Annual Report to stockholders with this notice and Proxy Statement.

| 2. |

|

|

March 6, 2018

KIRBY CORPORATION

| 3. | Ratify the Audit Committee’s selection of KPMG LLP as Kirby’s independent registered public accounting firm for 2020; and |

| 4. | Cast an advisory vote on executive compensation. |

PROXY STATEMENT

GENERAL INFORMATIONGeneral Information

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Kirby Corporation (the “Company”) to be voted at the Annual Meeting of Stockholders to be held at Kirby’s Houston offices, 55 Waugh Drive, 9th11th Floor, Houston, Texas 77007, on April 24, 2018,28, 2020, at 10:00 a.m. (CDT).

Whenever we refer in this Proxy Statement to the Annual Meeting, we are also referring to any meeting that results from an adjournment or postponement of the Annual Meeting. The Notice of Annual Meeting, this Proxy Statement,

Unless the proxy cardcontext requires otherwise, the terms “Kirby,” “the Company,” “our,” “we,” “us,” and the Company’s Annual Report, which includes the Annual Report on Form10-K for 2017, are being mailedsimilar terms refer to stockholders on or about March 15, 2018.Kirby Corporation, together with its consolidated subsidiaries.

SOLICITATION OF PROXIES

The Proxy Card

Your shares will be voted as specified on the enclosed proxy card. If a proxy is signed without choices specified, those shares will be voted for the election of the Class II directors named in this Proxy Statement, for the ratification of the Audit Committee’s selection of KPMG LLP as the Company’s independent registered public accounting firm for 2018, for the approval on an advisory basis of executive compensation and at the discretion of the proxies on other matters.

You are encouraged to complete, sign and return the proxy card even if you expect to attend the meeting. If you sign a proxy card and deliver it to us, but then want to change your vote, you may revoke your proxy at any time prior to the Annual Meeting by sending us a written revocation or a new proxy, or by attending the Annual Meeting and voting your shares in person.

Cost of Soliciting Proxies

The cost of soliciting proxies will be paid by the Company. The Company has retained Georgeson LLC to solicit proxies at an estimated cost of $6,300, plusout-of-pocket expenses. Employees of the Company may also solicit proxies, for which the expense would be nominal and borne by the Company. Solicitation may be by mail, facsimile, electronic mail, telephone or personal interview.

VOTING

Stockholders Entitled to Vote

Stockholders of record at the close of business on March 1, 2018 will be entitled to notice of, and to vote at, the Annual Meeting. As of the close of business on March 1, 2018, the Company had 59,673,940 outstanding shares of common stock. Each share of common stock is entitled to one vote on each matter to come before the meeting.

Quorum and Votes Necessary to Adopt Proposals

In order to transact business at the Annual Meeting, a quorum consisting of a majority of all outstanding shares entitled to vote must be present. Abstentions and proxies returned by brokerage firms for which no voting instructions have been received from their beneficial owners will be counted for the purpose of determining

1

whether a quorum is present. A majority of the votes cast (not counting abstentions and broker nonvotes) is required for the election of directors (Proposal 1). A majority of the outstanding shares entitled to vote that are represented at the meeting in person or by proxy is required for the ratification of the selection of KPMG LLP as the Company’s independent registered public accounting firm for 2018 (Proposal 2). Proposal 3 is anon-binding advisory vote on matters related to executive compensation and therefore there is no voting standard for that proposal, since the voting results will be informational only.

Please note that if your shares are held in the name of a brokerage firm on your behalf, your broker may not vote your shares on the election of directors or the matters related to executive compensation without voting instructions from you.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 24, 2018

This Proxy Statement and the Company’s 2017 Annual Report, which includes the Annual Report on Form10-K filed with the Securities and Exchange Commission (“SEC”), are available electronically at www.edocumentview.com/kex.

The following proposals will be considered at the meeting:

| ||

| ||

| ||

The Board of Directors of the Company unanimously recommends that you vote “FOR” the Board’s nominees for director, “FOR” the selection of KPMG LLP as our independent registered public accounting firm for 2018 and “FOR” approval of our executive compensation.

ELECTION OF DIRECTORS (PROPOSAL 1)

The Bylaws of the Company provide that the Board shall consist of not fewer than three nor more than fifteen members and that, within those limits, the number of directors shall be determined by the Board. The Bylaws further provide that the Board shall be divided into three classes, with the classes being as nearly equal in number as possible and with one class being elected each year for a three-year term. The size of the Board is currently set at nine. Three Class II directors are to be elected at the 2018 Annual Meeting to serve until the Annual Meeting of Stockholders in 2021.

Each nominee named below is currently serving as a director and each has consented to serve for the new term, if elected. If any nominee becomes unable to serve as a director, an event currently not anticipated, the persons named as proxies in the enclosed proxy card intend to vote for a nominee selected by the present Board to fill the vacancy.

In addition to satisfying, individually and collectively, the Company’s Criteria for the Selection of Directors discussed under the “THE BOARD OF DIRECTORS — Governance Committee” below, each of the directors has extensive experience with the Company or in a business similar to one or more of the Company’s principal businesses or the principal businesses of significant customers of the Company. The brief biographies of each of the nominees and continuing directors below includes a summary of the particular experience and qualifications that led the Board to conclude that he or she should serve as a director.

2

Nominees for Election

The Board of Directors of the Company unanimously recommends that you vote “FOR” the election of each of the following nominees as a director.

Nominees for Election as Class II directors, to serve until the Annual Meeting of Stockholders in 2021

Mr. Davis is Executive Chairman

BOARD COMPOSITION & EXPERIENCE

*As of both EnLink Midstream GP, LLC, the general partner of EnLink Midstream Partners, LP, and EnLink Midstream Manager, LLC, the managing member of EnLink Midstream, LLC. EnLink Midstream Partners, LP and EnLink Midstream, LLC (collectively “EnLink Midstream”) are both publicly traded and listed on the New York Stock Exchange (“NYSE”). Mr. Davis served as President, Chief Executive Officer and a director of EnLink Midstream from 2014 to January 2018. Prior to the formation of EnLink Midstream in 2014 through the combination of Crosstex Energy and substantially all of the United States midstream assets of Devon Energy, Mr. Davis had served since 1996 as President and Chief Executive Officer of Crosstex Energy, as a director of Crosstex Energy since 2002 and in management roles with other companies in the energy industry since 1984. Mr. Davis serves as a member of the Audit Committee and the Compensation Committee. He is also a member and former president of the Natural Gas and Electric Power Society and the Dallas Wildcat Committee.March 2020

EnLink Midstream provides midstream energy services, including gathering, transmission, processing, fractionation, brine services and marketing of natural gas, natural gas liquids, condensate and crude oil. EnLink Midstream’s assets include an extensive pipeline network, processing plants, fractionation facilities, storage facilities, rail terminals, barge and truck terminals and an extensive fleet of trucks. Mr. Davis has extensive knowledge and experience in the transportation of hydrocarbons, which is the primary business of EnLink Midstream and its predecessors.

|

| |

|

| |

| KIRBY | 2020 PROXY STATEMENT | 5 | |

Mr. Miller is

In 2019, consolidated revenues declined 4% to $2.84 billion. The reduction was driven by a consultant and private investor. He served as Executive Vice President, Chemicals, of Flint Hills Resources, LP (“Flint Hills”), a company engaged16% decrease in crude oil refining, transportation and marketing, and the production of petrochemicals, from 2003 to 2006. From 1999 to 2003, he was Senior Vice President of Koch Chemical Company, a predecessor company of Flint Hills. Mr. Miller serves as a member of the Compensation Committee and the Governance Committee.

Mr. Miller has 30 years of experiencerevenues in the petrochemicaldistribution and refining business. A significant volume of petrochemical products and refined petroleum products are transported coastwise and onservices segment, but was partially offset by a 7% increase in revenues in the marine transportation segment. Growth in the marine transportation segment was primarily related to the inland waterwaysacquisition of Cenac’s marine transportation fleet in March, improved market conditions and petrochemicalspricing in inland and refined petroleum products representcoastal, and higher barge utilization in coastal. In the distribution and services segment, the revenue decline was driven by a major portion ofcyclical downturn in the Company’s business, so Mr. Miller’s extensive knowledge about petrochemicaloil and refining companies,gas market which constitute a substantial part of the Company’s customer base,resulted in reduced orders for new and remanufactured pressure pumping equipment, as well as lower demand for equipment sales, service, and parts. This was partially offset by growth in the products they shipcommercial and industrial market, particularly for the sale of back-up power systems in power generation.

Despite the overall revenue reduction, operating income, excluding one-time items1, increased 5% to $282.3 million, with strength in marine transportation and cost reduction efforts in distribution and services more than offsetting the adverse impacts of reduced oilfield-related revenues. Earnings per share, excluding one-time items1, increased modestly to $2.90.

In 2019, Kirby generated $512 million in cash flow from operations. This cash flow was used to pay down debt and make additional investments in the marine transportation fleet. During the year, Kirby invested more than $300 million in acquisitions and new construction of marine equipment, including 64 inland barges representing 1.9 million barrels capacity, 41 inland towboats, and five coastal tugboats. At the end users of the products, is valuable2019, Kirby’s long-term debt balance was $1.37 billion, representing a reduction of more than $40 million compared to the Board. He also has experience in developing and administering incentive compensation programs at companies similar in size to the Company.2018, with a debt-to-capitalization ratio of 28.9%.

| 1 | Operating income, excluding one-time items, and earnings per share, excluding one-time items, are non-GAAP financial measures. Please refer to Appendix A for additional information and a reconciliation to the most directly comparable generally accepted accounting principles (“GAAP”) financial measures. |

|

| |

|

|

Mr. Pyne is the Chairman of the Board of the Company. Mr. Pyne is also a director and member of the audit and compensation committees of DHT Holdings, Inc. and a director and member of the compensation committee of Genesee & Wyoming Inc.

3

Mr. Pyne has been with the Company for 40 years, having served as President of its principal marine transportation subsidiary before serving as President and Chief Executive Officer of the Company from 1995 to 2010 and then as Chairman of the Board, President and Chief Executive Officer or Chairman of the Board and Chief Executive Officer of the Company until April 2014. Mr. Pyne has extensive knowledge of all aspects of the Company, its history, operations, customer base, financial condition and strategic planning. He has long been active in industry associations that, among other benefits, monitor significant legislative and regulatory developments affecting both the marine transportation and distribution and services businesses.

Directors Continuing in Office

The following persons are directors of the Company who will continue in office.

Continuing Class III directors, serving until the Annual Meeting of Stockholders in 2019

|

| |

|

|

Ms. Ainsworth served as President and Chief Executive Officer of the general partner of Oiltanking Partners, L.P. and of Oiltanking Holding Americas, Inc. (collectively “Oiltanking”), companies engaged in the terminaling, storage and transportation by pipeline of crude oil, refined petroleum products and liquefied petroleum gas, from 2012 until her retirement in 2014. Prior to joining Oiltanking, Ms. Ainsworth served as Senior Vice President, Manufacturing, for Sunoco, Inc. and before that served for 30 years in various managerial positions in the United States refining industry. Ms. Ainsworth serves as a member of the Audit Committee. She is also a director and member of the audit committee of Archrock, Inc., a director and member of the audit committee of Pembina Pipeline Corporation and a director of HollyFrontier Corporation and a former director of Seventy Seven Energy Inc.

Ms. Ainsworth has over 35 years of experience in executive and managerial positions in the United States refining industry with companies providing services for products that included crude oil and refined petroleum products, which constitute a significant percentage of the cargoes carried by the Company’s marine transportation business. She also has served as Chief Executive Officer of a public company.

|

| |

|

|

Mr. Day is Chairman Emeritus of Teekay Corporation, a diversified foreign flag shipping group. He serves as Chairman of the Compensation Committee and is a member of the Governance Committee. He is also a member of the Board of Teekay GP L.L.C., the general partner of Teekay LNG Partners L.P., and Chairman of Compass Diversified Holdings.

Mr. Day has over 45 years of experience in the marine transportation business, serving for the past 20 years as Chairman of one of the largest tanker companies in the world and 10 years before that as chief executive officer of an international bulk shipping company. In addition, Mr. Day has been active in the private equity investment business for the last 33 years, gaining extensive experience in financial management and analysis.

|

| |

|

|

Mr. Waterman served as President and Chief Executive Officer of Penn Maritime Inc. (“Penn”) from 1983 through 2012 until the acquisition of Penn by the Company in 2012. Penn was a coastal tank barge operator, transporting primarily refinery feedstocks, asphalt and crude oil along the East Coast and Gulf Coast of

4

the United States. He is also a director and past Chairman of The American Waterways Operators, the national trade association for the United States barge industry. Mr. Waterman serves as a member of the Governance Committee.

Mr. Waterman has over 36 years of experience in the coastal tank barge business with Penn and its predecessor companies, building Penn into one of the largest coastal tank barge operators in the United States. Mr. Waterman’s extensive experience in that business and knowledge of its markets and customers are valuable to the Board in its oversight of the Company’s coastal business and complement the inland marine transportation, midstream energy services and petrochemical industry experience of other Company directors.

Continuing Class I directors, serving until the Annual Meeting of Stockholders in 2020

|

| |

|

|

Mr. Alario served as Chief Executive Officer and a director of Key Energy Services, Inc. (“Key Energy”), a publicly traded oilfield service company listed on the NYSE, from 2004 until his retirement in March 2016. Prior to joining Key Energy, Mr. Alario served as Vice President of BJ Services Company, an oilfield service company, from 2002 to 2004, and served for over 21 years in various capacities, most recently Executive Vice President, of OSCA, Inc., also an oilfield service company. He serves as Chairman of the Governance Committee, is a member of the Audit Committee and has been chosen by thenon-management directors to serve as the presiding director at executive sessions of thenon-management directors. He currently serves asEx-Officio Chairman and Executive Committee member of the National Ocean Industries Association. Mr. Alario is a director and chairman of the compensation committee of Distribution Now.

Mr. Alario has over 35 years of experience in the oilfield service business, serving as Chief Executive Officer with both operating and financial responsibility for one of the largest oilfield service companies in the United States. That experience is valuable to the Board in its oversight of the Company’s distribution and services business which serves the oilfield services industry as a significant part of its customer base. As a former public company Chief Executive Officer, Mr. Alario adds that perspective to the collective experience of the independent directors.

|

| |

|

|

Mr. Grzebinski has served as President and Chief Executive Officer of the Company since April 2014. He served as President and Chief Operating Officer of the Company from January 2014 to April 2014, Executive Vice President from March 2010 to January 2014, as Chief Financial Officer from March 2010 to April 2014 and as Chairman of the Company’s principal offshore marine transportation subsidiary from February 2012 to April 2013. Prior to joining the Company in February 2010, he served in various administrative and operating positions with FMC Technologies Inc. (“FMC”), a global provider of advanced technology systems and products for the energy industry, including Controller, Energy Services, Treasurer, and Director of Global SAP and Industry Relations. Prior to joining FMC, he was employed by The Dow Chemical Company.

Mr. Grzebinski has primary responsibility for the business and strategic direction of the Company and is an essential link between the Board and the Company’sday-to-day operations. He has overall knowledge of all aspects of the Company, its operations, customers, financial condition and strategic planning.

|

| |

|

|

5

Mr. Stewart served as President and Chief Executive Officer of GE Aero Energy, a division of GE Energy, and as an officer of General Electric Company, from 1998 until his retirement in 2006. From 1972 to 1998, Mr. Stewart served in various positions at Stewart & Stevenson Services, Inc. (“Stewart and Stevenson”), including Group President and member of the Board of Directors. He serves as Chairman of the Audit Committee. Mr. Stewart is also a director of Exterran Corporation and serves on its audit and compensation committees, a director and Chairman of Eagle Materials Inc. and a former director of Lufkin Industries, Inc.

During a35-year business career, Mr. Stewart has been the principal executive officer with both operating and financial responsibility for the diesel engine and gas turbine power and service businesses at Stewart & Stevenson and then at GE Aero Energy. Mr. Stewart’s extensive experience in the diesel engine business is valuable to the Board in its oversight of the Company’s distribution and services business and complements the marine transportation and petrochemical industry experience of a number of the Company’s other directors.

THE BOARD OF DIRECTORSCORPORATE GOVERNANCE

The Company’s business is managed underBoard represents the direction of the Board, whichstockholders’ interest and is responsible for broad corporate policy and foroverseeing Company management, including monitoring the effectiveness of Company management. Members ofmanagement practices and decisions. To that end, the Board are kept informed about the Company’s businesses by participating in meetings of the Board and its committees, through operating and financial reports made at Board and committee meetings by Company management, through various reports and documents sent to the directors for their review and by visiting Company facilities.

Director Independence

The NYSE listing standards require listed companies to have at least a majority of independent directors. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with the Company.

The Board has determined that the following incumbent directors have no relationship with the Company except as directors and stockholders and are independent within the meaning of the NYSE corporate governance rules:

|

| |

|

| |

|

| |

|

6

Board Committees

The Board has established three standing committees,governance practices including the Audit Committee, the Compensation Committee and the Governance Committee, each of which is briefly described below.

Audit Committee

All of the members of the Audit Committee are independent, as that term is defined in applicable SEC and NYSE rules. In addition, the Board has determined that all of the members of the Audit Committee are “audit committee financial experts,” as that term is defined in SEC rules. The Audit Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

|

| |

| ||

| ||

| ||

|

Compensation Committee

All of the members of the Compensation Committee are independent, as that term is defined in applicable SEC and NYSE rules. In addition, all of the members of the Compensation Committee are“Non-Employee Directors” and “outside directors” as defined in relevant federal securities and tax regulations. The Compensation Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s web site at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

|

| |

| ||

|

7

Governance Committee

All of the members of the Governance Committee are independent, as that term is defined in NYSE rules. The Governance Committee operates under a written charter adopted by the Board. A copy of the charter is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

|

| |

| ||

|

The Governance Committee will consider director candidates recommended by stockholders or proposed by stockholders in accordance with the Company’s Bylaws. Recommendations may be sent to the Chairman of the Governance Committee, Kirby Corporation, 55 Waugh Drive, Suite 1000, Houston, Texas 77007, accompanied by biographical information for evaluation. The Board of the Company has approved Criteria for the Selection of Directors which the Governance Committee will consider in evaluating director candidates. The criteria address compliance with SEC and NYSE requirements relating to the composition of the Board and its committees, as well as character, integrity, experience, understanding of the Company’s business and willingness to commit sufficient time to the Company’s business. The criteria are available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Corporate Governance.

In addition to the criteria, the Governance Committee and the Board will consider diversity in business experience, professional expertise, gender and ethnic background in evaluating potential nominees for director. The Company’s Corporate Governance Guidelines and Governance Committee Charter include provisions concerning the consideration of diversity in business experience, professional skills, gender and ethnic background in selecting nominees for director.

When there is a vacancy on the Board (i.e., in cases other than the nomination of an existing director for reelection), the Board and the Governance Committee have considered candidates identified by executive search firms, candidates recommended by stockholders and candidates recommended by other directors. The Governance Committee will continue to consider candidates from any of those sources when future vacancies occur. The Governance Committee does not evaluate a candidate differently based on whether or not the candidate is recommended by a stockholder.

Attendance at Meetings

It is the Company’s policy that directors are expected to attend Board meetings and meetings of committees on which they serve and are expected to attend the Annual Meeting of Stockholders of the Company. During 2017, the Board met 11 times, the Audit Committee met eight times, the Compensation Committee met five times and the Governance Committee met four times. Each director attended more than 95% of the aggregate number of meetings of the Board and all of the committees on which he or she served. All directors attended the 2017 Annual Meeting of Stockholders of the Company.

Director Compensation

Directors who are employees of the Company receive no additional compensation for their service on the Board. Compensation of nonemployee directors is determined by the full Board, which may consider recommendations of the Compensation Committee. Past practice has been to review director compensation when the Board believes that an adjustment may be necessary in order to remain competitive with director compensation of comparable companies. Management of the Company periodically collects published survey information on director compensation for purposes of comparison.

8

Each nonemployee director receives an annual fee of $75,000. A director may elect to receive the annual fee in cash, stock options or restricted stock. The Chairman of the Audit Committee receives an additional annual fee of $20,000, the Chairman of the Compensation Committee receives an additional annual fee of $15,000 and the Chairman of the Governance Committee receives an additional annual fee of $10,000. The presiding director at executive sessions of thenon-management directors receives an additional annual fee of $20,000. In addition, each director receives an annual fee of $7,500 for each committee of the Board on which he or she serves. All fees are payable in four equal quarterly payments made at the end of each calendar quarter. The annual director fee is prorated for any director elected between annual stockholder meetings and the committee chairman, presiding director and committee member fees are prorated for any director who is elected to such position between annual meetings of the Board. Directors are reimbursed for reasonable expenses incurred in attending meetings.

Each nonemployee director will receive a fee of $3,000 for each board meeting attended, in person or by telephone, in excess of six meetings in any one calendar year. Each member of a committee of the board will receive a fee of $3,000 for each committee meeting attended, in person or by telephone, in excess of ten meetings in any one calendar year in the case of the Audit Committee, in excess of eight meetings in any one calendar year in the case of the Compensation Committee and in excess of eight meetings in any one calendar year in the case of the Governance Committee.

In addition to the fees described above provided to the directors, the Company has a stock award plan for nonemployee directors of the Company which provides for the issuance of stock options and restricted stock. The director plan provides for automatic grants of restricted stock to nonemployee directors after each annual meeting of stockholders. Each director receives restricted shares of the Company’s common stock after each annual meeting of stockholders. The number of shares of restricted stock issued is equal to (a) $167,500 divided by (b) the fair market value of a share of stock on the date of grant multiplied by (c) 1.2. The director plan also provides for discretionary grants of an aggregate of 10,000 shares in the form of stock options or restricted stock. In addition, the director plan allows for the issuance of stock options or restricted stock in lieu of cash for all or part of the annual director fee at the option of the director. A director who elects to receive options in lieu of the annual cash fee will be granted an option for a number of shares equal to (a) the amount of the fee for which the election is made divided by (b) the fair market value per share of the common stock on the date of grant multiplied by (c) 3. A director who elects to receive restricted stock in lieu of the annual cash fee will be issued a number of shares of restricted stock equal to (a) the amount of the fee for which the election is made divided by (b) the fair market value per share of the common stock on the date of grant multiplied by (c) 1.2. The exercise price for all options granted under the director plan is the fair market value per share of the Company’s common stock on the date of grant. The restricted stock issued after each annual meeting of stockholders vests six months after the date of issuance. Options granted and restricted stock issued in lieu of cash director fees vest in equal quarterly increments during the year to which they relate. The options generally remain exercisable for ten years after the date of grant.

The Board has established stock ownership guidelines for officers and directors of the Company. Nonemployee directors must be in compliance within five years after first election as a director, but are expected to accumulate the required number of shares ratably over the applicable five-year period. Under the guidelines, nonemployee directors are required to own common stock of the Company having a value equal to four times the annual cash director fee. As of December 31, 2017, all directors were in compliance with the stock ownership guidelines. The Governance Committee of the Board will monitor compliance with the guidelines and may recommend modifications or exceptions to the Board.charters described below.

9

The following table summarizes the cash and equity compensation for nonemployee directors for the year ended December 31, 2017:

Director Compensation for 2017

Name | Fees Earned or Paid in Cash | Stock Awards(1)(2) | Option Awards(1)(2) | Total | ||||||||||||

Anne-Marie N. Ainsworth | $ | 97,500 | $ | 201,072 | $ | — | $ | 298,572 | ||||||||

Richard J. Alario | 132,000 | 201,072 | — | 333,072 | ||||||||||||

Barry E. Davis | 30,000 | 201,072 | 76,212 | 307,284 | ||||||||||||

C. Sean Day | 45,000 | 291,216 | — | 336,216 | ||||||||||||

Monte J. Miller | 105,000 | 201,072 | — | 306,072 | ||||||||||||

Richard R. Stewart | 117,500 | 201,072 | — | 318,572 | ||||||||||||

William M. Waterman | 97,500 | 201,072 | — | 298,572 | ||||||||||||

|

|

The following table shows the aggregate number of shares of unvested restricted stock and stock options outstanding for each director as of December 31, 2017, as well as the grant date fair value of restricted stock awards and stock option grants made during 2017:

Name | Aggregate Shares of Unvested Restricted Stock as of December 31, 2017 | Aggregate Stock Options Outstanding as of December 31, 2017 | Grant Date Fair Value of Restricted Stock and Stock Options Awarded during 2017 | |||||||||

Anne-Marie N. Ainsworth | — | — | $ | 201,072 | ||||||||

Richard J. Alario | — | 29,153 | 201,072 | |||||||||

Barry E. Davis | — | 3,188 | 277,284 | |||||||||

C. Sean Day | 319 | 36,000 | 291,216 | |||||||||

Monte J. Miller | — | 43,276 | 201,072 | |||||||||

Richard R. Stewart | — | 24,000 | 201,072 | |||||||||

William M. Waterman | — | 22,000 | 201,072 | |||||||||

Board Leadership Structure

The Board has no set policy concerning the separation of the offices of Chairman of the Board and Chief Executive Officer, but retains the flexibility to decide how the two positions should be filled based on the circumstances existing at any given time. Following Mr. Grzebinski’s succession to the position of President and Chief Executive Officer in 2014, the Board considered it important for Mr. Pyne, with his comprehensive understanding of the Company’s businesses and strategic direction, to continue in the role of an executive Chairman of the Board. During the same time period, the Board was focused on management succession planning, primarily for the role of Chief Executive Officer but also for other senior management positions. The Board determined that having Mr. Pyne continue to serve as an executive Chairman of the Board after relinquishing the role of Chief Executive Officer would facilitate the succession process and provide valuable support to the senior management team.

10

The Board does not have a “lead director,” but has chosen Mr. Alario to be the “presiding director” to preside at the regular executive sessions of thenon-management directors that are held at least quarterly. Mr. Alario also serves as a liaison between the independent directors and management on certain matters that are not within the area of responsibility of a particular committee of the Board.

Risk Oversight

The Board carries out its risk oversight function through the Audit Committee and the full Board. Management prepares and reviews with the Audit Committee and the Board semiannually a comprehensive assessment of the identified internal and external risks of the Company that includes evaluations of the potential impact of each identified risk, its probability of occurrence and the effectiveness of the controls that are in place to mitigate the risk. The Audit Committee and the Board also receive regular reports of any events or circumstances involving risks outside the normal course of business of the Company. At times, a particular risk will be monitored and evaluated by another Board committee with primary responsibility in the area involved, such as the Compensation Committee’s review of the risks related to the Company’s compensation policies and practices. The Board’s administration of its risk oversight function has not affected the Board’s leadership structure.

TRANSACTIONS WITH RELATED PERSONS

The Board has adopted a written policy on transactions with related persons that provides that certain transactions involving the Company and any of its directors, executive officers or major stockholders or members of their immediate families, including all transactions that would be required to be disclosed as transactions with related persons in the Company’s Proxy Statement, are subject to approval in advance by the Governance Committee, except that a member of the Committee will not participate in the review of a transaction in which that member has an interest. The Committee has the discretion to approve any transaction which it determines is in, or not inconsistent with, the best interests of the Company and its stockholders. If for any reason a transaction with a related person has not previously been approved, the Committee will review the transaction within a reasonable period of time and either ratify the transaction or recommend other actions, including modification, rescission or termination, taking into consideration the Company’s contractual obligations. If a transaction is ongoing or consists of a series of similar transactions, the Committee will review the transaction at least annually and either ratify the continuation of the transaction or recommend other actions, including modification, rescission or termination, taking into consideration the Company’s contractual obligations. The policy provides certain exceptions, including compensation approved by the Board or its Compensation Committee.

The husband of Amy D. Husted, Vice President and General Counsel of the Company, is a partner in the law firm of Strasburger & Price, LLP. The Company paid the law firm $830,000 in 2017 for legal services. Mr. Grzebinski approves each engagement of the firm by the Company and the payment of fees billed by the firm.

CORPORATE GOVERNANCE

Business Ethics Guidelines

The Board has adopted Business Ethics Guidelines that apply to all directors, officers and employees of the Company. A copy of the Business Ethics Guidelines is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Corporate Governance.Governance/Governance Overview. The Company is required to make prompt disclosure of any amendment to or waiver of any provision of its Business Ethics Guidelines that applies to any director or executive officer or toincluding its chief executive officer, chief financial officer, chief accounting officer or controller, or persons performing similar functions. The Company will make any such disclosure that may be necessary by posting the disclosure on its website at www.kirbycorp.com in the Investor Relations section under Corporate Governance.Governance/Governance Overview.

11

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines. A copy of the guidelines is available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Corporate Governance.Governance/Governance Overview.

Communication with Directors

Interested parties, including stockholders, may communicate with the full Board or any individual directors, including the Chairmen of the Audit, Compensation and Governance Committees, the presiding director or thenon-management or independent directors as a group, by writing to them c/o Kirby Corporation, 55 Waugh Drive, Suite 1000,P.O. Box 1745, Houston, Texas 77007.77251-1745. The Company will refer the communication to the appropriate addressee(s). Complaints about accounting, internal accounting controls or auditing matters should be directed to the Chairman of the Audit Committee at the same address. All communications will be forwarded to the person(s) to whom they are addressed.

Website Disclosures

The following documents and information are available on the Company’s website at www.kirbycorp.com in the Investor Relations section under Corporate Governance:Governance/Governance Overview:

Audit Committee Charter

Compensation Committee Charter

Governance Committee Charter

Criteria for the Selection of Directors

Business Ethics Guidelines

Corporate Governance Guidelines

Communication with Directors

| KIRBY | 2020 PROXY STATEMENT | PROXY SUMMARY 7 | |

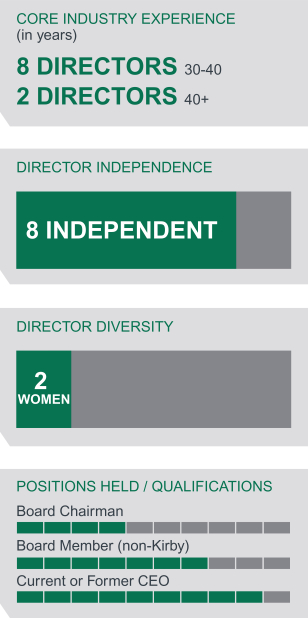

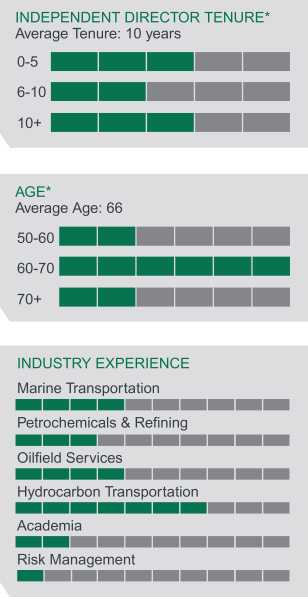

Our Board prides itself on its commitment to high ethical standards, effective governance practices, and expertise within the industries in which we operate.

In October 2019, the Board was expanded from nine to ten directors and enhanced with the election of Tanya S. Beder as the tenth director. Ms. Beder’s extensive background in professional, board, and academic disciplines, as well as her wealth of experience in asset and risk management, finance, and data analytics will be immensely valuable to Kirby’s future success.

| TOPIC | PRACTICE | |

| Independence | • Eight out of ten director nominees are independent | |

| • Board committees are composed entirely of independent directors | ||

| Independent Presiding Director | • Richard J. Alario serves as the Independent Presiding Director | |

| Diversity | • Two out of ten directors are female | |

| Executive Sessions | • Non-management directors meet regularly without management | |

| Majority Voting | • Majority of votes cast is required for the election of directors | |

| Director Evaluations | • Evaluations of the full board and each committee are conducted annually | |

| Stock Ownership | • Stock ownership guidelines established for directors | |

| Single Voting Class | • Kirby has a single class of voting stock | |

| Hedging and Pledging of Stock | • Hedging and pledging of company stock are prohibited by directors, officers, and employees | |

| Business Ethics Guidelines | • Ethics guidelines apply to all our directors, officers, and employees | |

| 8 PROXY SUMMARY | KIRBY | 2020 PROXY STATEMENT | |

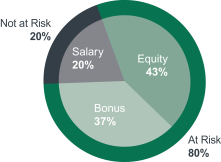

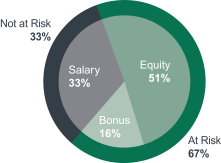

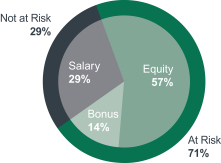

Our executive compensation philosophy has been consistent and focused on the creation of value for our stakeholders. A significant portion of our named executive officers’ compensation is tied to “At Risk” or pay-for-performance components. The charts below depict how each element of compensation was weighted for our named executive officers in 2019.

Our executive compensation program is designed to attract and retain talented executive officers, motivate consistent performance over time, and encourage performance that results in increased profitability and stockholder returns. Our executive compensation program has historically received high levels of stockholder support well above 90%. In 2018, while there were no material changes to our executive compensation program, the approval rating declined at the 2019 Annual Meeting as a result of some stockholders voting against a one-time special retirement payment granted by the Board of Directors to our former Executive Chairman. For 2019, we did not have any special one-time payments, and the core of our executive compensation program remained unchanged. Listed below are some of the highlights of our compensation policies and practices:

TOPIC | PRACTICE | |

| Pay-for-Performance Focus | • Performance-based cash annual incentive compensation rewards current year financial and operational success | |

• Performance-based cash and equity long-term incentive awards incentivize future growth and profitability | ||

• Awards are based on EBITDA, Return on Invested Capital, and Earnings per Share metrics which correlate highly to long-term stockholder returns | ||

| AnnualSay-on-Pay Vote | • We annually ask stockholders to provide an advisory vote on executive compensation | |

| Equity Ownership Guidelines | • Stock ownership guidelines are established for executive officers | |

| Golden Parachutes | • We do not have employment agreements with executive officers | |

| Independent Compensation Consultant | • The Compensation Committee has retained a nationally recognized compensation consulting firm to serve as its independent compensation consultant | |

| Double-Trigger Vesting | • We have adopted double-trigger vesting of equity awards upon a change in control | |

| Excise TaxGross-Ups | • We do not provide executive officers with excise taxgross-ups | |

| Re-pricing Stock Options | • We do notre-price stock options | |

| Evergreen Equity Plans | • We do not have any evergreen provisions in our equity compensation plan |

PRESIDENT AND CEO | EXECUTIVE VP AND CFO | OTHER NEO | ||

COMPENSATION | COMPENSATION | COMPENSATION | ||

|  |  | ||

NOTE: Includes total direct compensation as referred to in the compensation discussion and analysis on page 29. “Bonus” includes non-equity incentive plan compensation. For additional information, reference the Summary Compensation Table on page 36.

| KIRBY | 2020 PROXY STATEMENT | 9 | |

Throughout 2019, senior management and investor relations engaged with our stockholders and potential stockholders on a regular basis to share information on the Company, listen to their perspectives, and solicit feedback. In 2019, we conducted nearly 200 phone calls and in-house one-on-one meetings which connected us to more than 250 investors and analysts. We attended 12 equity conferences and investor events across the United States, and we hosted several investor events at our key operating facilities in Houston and Oklahoma City.

In October, Kirby’s executive management team hosted our top 50 stockholders and sell-side analysts at a reception with the Board of Directors in New York City. This event was well attended and provided our top stockholders with a valuable opportunity to engage with the Board and the Company’s executive leadership.

Kirby has a long history of promoting sustainability as part of our corporate culture, and our “NO HARM” principles – NO HARM to People, to the Environment, and to Equipment is the foundation of our culture. We view sustainability as integral to the continued advancement of our NO HARM culture and strive to integrate it as part of our business strategy. Kirby’s core values of responsible operation, valuing our employees, and acting as stewards of the environment in the communities we operate shape our initiatives and strategies. Kirby has a long-standing history of investing in new equipment and technologies that improve its operations and support its environmental stewardship initiatives. We support our employees through extensive training and development programs, and continuously emphasize our high safety standards.

During 2019, we took concrete steps to improve our sustainability disclosures. In our 2019 Sustainability Report, we provided historical safety statistics which disclose our record on employee injuries, harm to equipment, and cargo spills to the environment. This report is available on the Company’s website at www.kirbycorp.com in the Sustainability section under ESG Presentation. Additionally, we provided new disclosures on our safety programs, management and audit oversight, and best practices which we utilize in operations every day. We also expanded our reporting on social matters, including enhanced disclosures on our employee benefit programs and community involvement. Additionally, we expanded the oversight of our sustainability program beyond executive leadership to include the Board of Directors. Our Governance Committee charter now includes environmental, social, and governance (“ESG”) oversight. Finally, we added dedicated employee resources to further enhance our disclosures and improve our engagement with ESG stakeholders.

In 2020, a key focus is to provide new disclosures on Kirby’s greenhouse gas emissions. We will also be working to align our ESG disclosures with the Sustainability Accounting Standards Board framework and the Task Force on Climate-Related Disclosures.

To learn more about these programs and initiatives, please visit the Corporate Sustainability section of our website at www.kirbycorp.com.

12

| 10 PROXY SUMMARY | KIRBY | 2020 PROXY STATEMENT | |

BENEFICIAL OWNERSHIPTABLE OF COMMON STOCKCONTENTS

| 1 | ||

| 2 | ||

| 3 | ||

| 4 | ||

| 4 | ||

| 5 | ||

| 6 | ||

| 7 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 11 | ||

| 11 | ||

| 13 | ||

| 14 | ||

| 17 | ||

| 17 | ||

| 17 | ||

| 17 | ||

| 18 | ||

| 18 | ||

| 18 | ||

| 19 | ||

| 19 | ||

| 20 | ||

| 23 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 25 | ||

| 26 | ||

| 26 | ||

| 26 | ||

| 26 | ||

| 29 | ||

| 34 | ||

| 35 | ||

| 36 | ||

| 36 | ||

| 37 | ||

| 38 | ||

| 39 | ||

| 39 | ||

| 40 | ||

| 40 | ||

| 43 | ||

| 43 | ||

| 44 | ||

| 45 | ||

| 46 | ||

| 47 | ||

| 48 | ||

| 48 | ||

| 50 | ||

| 50 | Appendix A: Reconciliation of GAAP to Non-GAAP Measures Excluding One-Time Items | |

| 51 | Appendix B: Reconciliation of GAAP Net Earnings to Non-GAAP EBITDA | |

| KIRBY | 2020 PROXY STATEMENT | 11 | |

ELECTION OF DIRECTORS

The Bylaws of the Company provide that the Board shall consist of not fewer than three nor more than fifteen members and that, within those limits, the number of directors shall be determined by the Board. The Bylaws further provide that the Board shall be divided into three classes, with the classes being as nearly equal in number as possible and with one class being elected each year for a three-year term. The size of the Board is currently set at ten. Three Class I directors are to be elected at the 2020 Annual Meeting to serve until the Annual Meeting of Stockholders in 2023 and one Class II director is to be elected at the 2020 Annual Meeting to serve until the Annual Meeting of Stockholders in 2021.

Ms. Beder was elected to the Board in October 2019 as a Class I director. In January 2020, the Board decided to decrease the number of Class I directors from four to three effective in April 2020 and to increase the size of the Class II directors from three to four also effective in April 2020. It was determined that this change would affect Ms. Beder’s directorship. Therefore, Ms. Beder has been nominated for election as a Class II director.

Each nominee named below is currently serving as a director and each has consented to serve for the new term, if elected. If any nominee becomes unable to serve as a director, an event currently not anticipated, the persons named as proxies in the enclosed proxy card intend to vote for a nominee selected by the present Board to fill the vacancy.

In addition to satisfying, individually and collectively, the Company’s Criteria for the Selection of Directors discussed under the “THE BOARD OF DIRECTORS — Governance Committee” below, each of the directors has extensive experience with the Company or in a business similar to one or more of the Company’s principal businesses or the principal businesses of significant customers of the Company. The brief biographies of each of the nominees and continuing directors below include a summary of the particular experience and qualifications that led the Board to conclude that he or she should serve as a director.

NOMINEES FOR ELECTION (PROPOSAL 1)

The Board of Directors of the Company unanimously recommends that you vote “FOR” the election of each of the following nominees as a director.

Nominees for Election as Class I directors, serving until the Annual Meeting of Stockholders in 2023

| RICHARD J. ALARIO | ||

Director Since: 2011 Age: 65 Houston, Texas

| Mr. Alario served as Chief Executive Officer and a director of Key Energy Services, Inc. (“Key Energy”), a publicly traded oilfield service company listed on the New York Stock Exchange (“NYSE”), from 2004 until his retirement in March 2016. Prior to joining Key Energy, Mr. Alario served as Vice President of BJ Services Company, an oilfield service company, from 2002 to 2004, and prior to that served for over 21 years in various capacities, most recently Executive Vice President, of OSCA, Inc., also an oilfield service company. He serves as Chairman of the Company’s Governance Committee, is a member of the Audit Committee and has been chosen by thenon-management directors to serve as the presiding director at executive sessions of thenon-management directors. Mr. Alario has also served as a director of NOW Inc. since May 2014 and as its interim Chief Executive Officer since November 2019. Mr. Alario has over 35 years of experience in the oilfield service business, serving as Chief Executive Officer with both operating and financial responsibility for one of the largest oilfield service companies in the United States. That experience is valuable to the Board in its oversight of the Company’s distribution and services business which serves the oilfield services industry as a significant part of its customer base. As a former public company Chief Executive Officer, Mr. Alario adds that perspective to the collective experience of the independent directors. | |

| 12 | KIRBY| 2020 PROXY STATEMENT | |

| DAVID W. GRZEBINSKI | ||

Director Since: 2014 Age: 58 Houston, Texas

| Mr. Grzebinski has served as President and Chief Executive Officer of the Company since April 2014. He served as President and Chief Operating Officer of the Company from January 2014 to April 2014, Executive Vice President from March 2010 to January 2014, as Chief Financial Officer from March 2010 to April 2014 and as Chairman of the Company’s principal offshore marine transportation subsidiary from February 2012 to April 2013. Prior to joining the Company in February 2010, he served in various operational and financial positions with FMC Technologies Inc. (“FMC”), a global provider of advanced technology systems and products for the energy industry. Prior to joining FMC, he was employed by The Dow Chemical Company in manufacturing, engineering and financial roles. Mr. Grzebinski serves as a director of The Coast Guard Foundation and as a director of the American Bureau of Shipping. Mr. Grzebinski has primary responsibility for the business and strategic direction of the Company and is an essential link between the Board and the Company’sday-to-day operations. He has overall knowledge of all aspects of the Company, its operations, customers, financial condition and strategic planning. | |

| RICHARD R. STEWART | ||

Director Since: 2008 Age: 70 Houston, Texas

| Mr. Stewart served as President and Chief Executive Officer of GE Aero Energy, a division of GE Energy, and as an officer of General Electric Company, from 1998 until his retirement in 2006. From 1972 to 1998, Mr. Stewart served in various positions at Stewart & Stevenson, including Group President and member of the Board of Directors. He serves as Chairman of the Company’s Audit Committee. Mr. Stewart is also a director and former Chairman of Eagle Materials Inc. and a former director of Exterran Corporation. During a35-year business career, Mr. Stewart has been the principal executive officer with both operating and financial responsibility for the diesel engine and gas turbine power and service businesses at Stewart & Stevenson and then at GE Aero Energy. Mr. Stewart’s extensive experience in the engine and power products business is valuable to the Board in its oversight of the Company’s distribution and services business and complements the marine transportation and petrochemical industry experience of a number of the Company’s other directors. | |

| KIRBY | 2020 PROXY STATEMENT | 13 | |

NOMINEE FOR ELECTION (PROPOSAL 2)

The Board of Directors of the Company unanimously recommends that you vote “FOR” the election the following nominee as a director.

Nominee for Election as Class II director, serving until the Annual Meeting of Stockholders in 2021

| TANYA S. BEDER | ||

Director Since: 2019 Age: 64 Jackson Hole, Wyoming

| Ms. Beder is currently the Chairman and Chief Executive Officer of a firm she founded in 1987, SBCC Group, ‘Strategy Building and Crisis Control’, where she heads the global strategy, risk, fintech and asset management practices. Previously, Ms. Beder held senior roles as Chief Executive Officer of Tribeca Global Management, a subsidiary of Citigroup, Managing Director & Head of Strategic Quantitative Investment Division at Caxton Associates, and President andCo-Founder of Capital Market Risk Advisors. Ms. Beder also spent time in various positions with The First Boston Corporation (now Credit Suisse) where she was a derivatives trader and was on the mergers and acquisitions team in New York and London. Since 2011, Ms. Beder has served on the board of American Century Investments where she chairs the Risk Management Oversight Committee, is a qualified financial expert on the Audit & Compliance Committee and is a member of the Portfolio Committee. Since 2017, Ms. Beder has also served as a member of the board at Nabors Industries where she is Chair of the Risk Oversight Committee, a qualified financial expert on the Audit Committee, and a member of the Compensation, Technology & Safety Committees. Ms. Beder previously served as a member on the board of directors from 2012 to 2017 of CYS Investments, where she was the chair of the Nominating and Corporate Governance Committee and served on the Audit and Compliance and Compensation Committees. Ms. Beder is currently a lecturer of public policy at Stanford University, is a Fellow in Practice at the Yale University International Center for Finance, and a member of the Mathematical Finance Advisory Board at New York University. Previously, Ms. Beder was on the Advisory Board of the Columbia University Financial Engineering Program, and a trustee at the Institute for Pure and Applied Mathematics at UCLA. Ms. Beder graduated with Bachelor of Arts degrees in Mathematics and Philosophy from Yale University and has a Master of Business Administration degree from Harvard Business School. Ms. Beder brings to the Board extensive asset management experience, vast knowledge of operational and risk management, and experience serving as a director for both public and private companies. Ms. Beder’s audit and risk oversight committee experience adds valuable perspective to the collective experience of the independent directors. | |

| 14 | KIRBY| 2020 PROXY STATEMENT | |

Directors Continuing in Office

The following persons are directors of the Company who will continue in office.

Continuing Class II directors, serving until the Annual Meeting of Stockholders in 2021

| BARRY E. DAVIS | ||

Director Since: 2015 Age: 58 Dallas, Texas

| Mr. Davis has served as Chairman of the board and Chief Executive Officer of both EnLink Midstream GP, LLC, the general partner of EnLink Midstream Partners, LP, and EnLink Midstream Manager, LLC, the managing member of EnLink Midstream, LLC since August 2019. EnLink Midstream Partners, LP and EnLink Midstream, LLC (collectively “EnLink Midstream”) are both publicly traded and listed on the NYSE. Mr. Davis served as Executive Chairman from January 2018 to August 2019 and as President, Chief Executive Officer and a director of EnLink Midstream from 2014 to January 2018. Prior to the formation of EnLink Midstream in 2014 through the combination of Crosstex Energy and substantially all of the United States midstream assets of Devon Energy, Mr. Davis had served since 1996 as President and Chief Executive Officer of Crosstex Energy, as a director of Crosstex Energy since 2002 and in management roles with other companies in the energy industry since 1984. Mr. Davis serves as a member of the Company’s Audit Committee and the Compensation Committee. He is also a member and former president of the Natural Gas and Electric Power Society and the Dallas Wildcat Committee. EnLink Midstream provides midstream energy services, including gathering, transmission, processing, fractionation, brine services and marketing of natural gas, natural gas liquids, condensate and crude oil. EnLink Midstream’s assets include an extensive pipeline network, processing plants, fractionation facilities, storage facilities, rail terminals, barge and truck terminals and an extensive fleet of trucks. Mr. Davis has extensive knowledge and experience in the transportation of hydrocarbons, which is the primary business of EnLink Midstream and its predecessors. | |

| MONTE J. MILLER | ||

Director Since: 2006 Age: 76 Durango, Colorado

| Mr. Miller has been a consultant and private investor since his retirement. He served as Executive Vice President, Chemicals, of Flint Hills Resources, LP (“Flint Hills”), a company engaged in crude oil refining, transportation and marketing, and the production of petrochemicals, from 2003 to 2006. From 1999 to 2003 when he retired, he was Senior Vice President of Koch Chemical Company, a predecessor company of Flint Hills. Mr. Miller serves as a member of the Company’s Compensation Committee and the Governance Committee. Mr. Miller has 30 years of experience in the petrochemical and refining business. A significant volume of petrochemical products and refined petroleum products are transported coastwise and on the inland waterways. Petrochemicals and refined petroleum products represent a major portion of the Company’s business, so Mr. Miller’s extensive knowledge about petrochemical and refining companies, which constitute a substantial part of the Company’s customer base, as well as the products they ship and the end users of the products, is valuable to the Board. He also has experience in developing and administering incentive compensation programs at companies similar in size to the Company. | |

| KIRBY | 2020 PROXY STATEMENT | 15 | |

| JOSEPH H. PYNE | ||

Director Since: 1988 Age: 72 Houston, Texas

| Mr. Pyne is the Chairman of the Board of the Company. Mr. Pyne retired as Executive Chairman of the Board on April 30, 2018, but continues to serve as Chairman of the Board in anon-executive capacity. Mr. Pyne is also a director and member of the audit, compensation and governance committees of DHT Holdings, Inc and a former director and member of the compensation committee of Genesee & Wyoming Inc. Prior to his retirement, Mr. Pyne had been an employee of the Company for 40 years, having served as President of its principal marine transportation subsidiary before serving as President and Chief Executive Officer of the Company from 1995 to 2010, then as Chairman of the Board, President and Chief Executive Officer or Chairman of the Board and Chief Executive Officer of the Company until April 2014 and then as Executive Chairman of the Board from April 2014 through April 2018. Mr. Pyne has extensive knowledge of all aspects of the Company, its history, operations, customer base, financial condition and strategic planning. He has long been active in industry associations that, among other benefits, monitor significant legislative and regulatory developments affecting both the marine transportation and distribution and services businesses. | |

Continuing Class III directors, serving until the Annual Meeting of Stockholders in 2022

| ANNE-MARIE N. AINSWORTH | ||

Director Since: 2015 Age: 63 Houston, Texas

| Ms. Ainsworth served as President and Chief Executive Officer of Oiltanking Partners, L.P. and of Oiltanking Holding Americas, Inc. from 2012 until her retirement in 2014. Ms. Ainsworth was Senior Vice President of Refining for Sunoco, Inc. from 2009 to 2012 and previously was the General Manager of the Motiva Enterprises, LLC (“Motiva”) refinery in Norco, LA from 2006 to 2009. Before she joined Motiva, Ms. Ainsworth was director of process safety management from 2003 to 2006 and Vice President of Technical Assurance at Shell Deer Park Refining Company from 2000 to 2003. Ms. Ainsworth serves as a member of the Company’s Audit Committee. She is currently on the boards of Pembina Pipeline Corporation (serves as chair of its safety and environment committee and a member of its compensation committee), HollyFrontier Corporation (member of the environmental, health, safety, and public policy committee and a member of its finance committee), and Archrock, Inc. (serves as chair of its nominating and corporate governance committee and a member of its audit committee). Ms. Ainsworth graduated from the University of Toledo with a Bachelor of Science in Chemical Engineering, and she holds a Masters in Business Administration from Rice University where she served as an adjunct professor from 2000 to 2009. She is also a graduate of the Institute of Corporate Directors Education Program (Rotman School of Management, University of Toronto) and holds the ICD.D designation. Ms. Ainsworth has over 35 years of experience in executive and managerial positions in the United States refining industry with companies providing services for products that included crude oil and refined petroleum products, which constitute a significant percentage of the cargoes carried by the Company’s marine transportation business. She also has served as Chief Executive Officer of a public company. | |

| 16 | KIRBY| 2020 PROXY STATEMENT | |

| C. SEAN DAY | ||

Director Since: 1996 Age: 70 Greenwich, Connecticut

| Mr. Day has served as a member of the board of Teekay GP LLC (the general partner of Teekay LNG Partners LP) since 2004. Prior to his retirement from their board in 2019, Mr. Day was Chairman Emeritus of Teekay Corporation, a diversified foreign flag shipping group. He is also Chairman of Compass Diversified Holdings. Mr. Day serves as the Chairman of the Company’s Compensation Committee and a member of the Governance Committee. Mr. Day has over 45 years of experience in the marine transportation business, serving for over 22 years as Chairman of one of the largest tanker companies in the world and 10 years before that as Chief Executive Officer of an international bulk shipping company. In addition, Mr. Day has been active in the private equity investment business for the last 35 years, gaining extensive experience in financial management and analysis. | |

| WILLIAM M. WATERMAN | ||

Director Since: 2012 Age: 66 Bedford, New York

| Mr. Waterman served as President and Chief Executive Officer of Penn Maritime Inc. (“Penn”) from 1983 through 2012 until the acquisition of Penn by the Company in 2012 when he retired. Penn was a coastal tank barge operator, transporting primarily refinery feedstocks, asphalt and crude oil along the East Coast and Gulf Coast of the United States. He is also a director and past Chairman of The American Waterways Operators, the national trade association for the United States barge industry. Mr. Waterman serves as a member of the Company’s Governance Committee. Mr. Waterman has over 36 years of experience in the coastal tank barge business with Penn and its predecessor companies, building Penn into one of the largest coastal tank barge operators in the United States. Mr. Waterman’s extensive experience in that business and knowledge of its markets and customers are valuable to the Board in its oversight of the Company’s coastal business and complement the inland marine transportation, midstream energy services and petrochemical industry experience of other Company directors. | |

| KIRBY | 2020 PROXY STATEMENT | 17 | |

The Company’s business is managed under the direction of the Board, which is responsible for broad corporate policy and for monitoring the effectiveness of Company management. Members of the Board are kept informed about the Company’s businesses by participating in meetings of the Board and its committees, through operating and financial reports made at Board and committee meetings by Company management, through various reports and documents sent to the directors for their review and by visiting Company facilities. The Board’s development includes onsite meetings at key operating facilities which include interaction with employees at those locations.

The NYSE listing standards require listed companies to have at least a majority of independent directors. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with the Company.

The Board has determined that the following incumbent directors have no relationship with the Company except as directors and stockholders and are independent within the meaning of the NYSE corporate governance rules:

| Anne-Marie N. Ainsworth | C. Sean Day | |||

| Richard J. Alario | Monte J. Miller | |||

| Tanya S. Beder | Richard R. Stewart | |||

| Barry E. Davis | William M. Waterman | |||

Our Chief Executive Officer, Mr. Grzebinski, has certified to the NYSE that the Company is in compliance with NYSE corporate governance listing standards.

The Board carries out its risk oversight function through the Audit Committee and the full Board. Management prepares and reviews with the Audit Committee and the Board semiannually a comprehensive assessment of the identified internal and external risks of the Company that includes evaluations of the potential impact of each identified risk, its probability of occurrence and the effectiveness of the controls that are in place to mitigate the risk. The Audit Committee and the Board also receive regular reports of any events or circumstances involving risks outside the normal course of business of the Company. At times, a particular risk will be monitored and evaluated by another Board committee with primary responsibility in the area of the subject matter involved. For example, the Compensation Committee reviews the risks related to the Company’s compensation policies and practices and the Audit Committee receives regular reports and updates on cybersecurity issues. The Board’s administration of its risk oversight function has not affected the Board’s leadership structure.